Part Two: Psyched for Saving

I got paid today, and I have been very excited about it for days now. The reason I was so excited is that today I will finish funding my 1000 dollar emergency fund. So, for the first time in my life, I was excited to save. It feels funny, actually. Dave Ramsey was really right, though, it feels really good to know that I have money in case something happens.

Actually, I need to confess something right now. I have not read Dave Ramsey's books. I have read summaries of them on about 10 websites, but not the books. I placed interlibrary loan requests for two books the other day, The Total Money Makeover and another book that I totally can't remember right now but it's about money and happiness. I should be getting them tomorrow or early next week, so I can read them and then stop pretending like I know what Dave Ramsey says.

Okay, so anyway, I'm so excited to put money in my fancy ING savings account. If you don't have a fancy ING savings account, you should consider getting one. Look though financial magazines like Kiplinger's for promotion codes- you can often get one that will earn you 25 extra dollars in your account. Awesome!

I'm assuming (based on my fake Dave Ramsey knowledge) that the next step is to start paying off my smallest debt, which is a small loan I had to roll over from my old car loan when my old car died and I bought the car I currently have. It's very small, so I should be done with that one soon.

This is fun!

31 July 2008

30 July 2008

Spending Plans

After nearly 2 days of reading, researching and thinking about spending plans, I haven't come up with that much. This is the best way I can explain my spending issue:

You know how sometimes you're really hungry, and you're going to cook dinner, but you don't know what you want so you end up eating a bunch of random stuff out of the fridge, and then you realize you're full and you had potato chips, Camembert and an apple for dinner? (That's what I had last night when this happened to me). And then you're sort of pissed, because you had all kinds of good, healthy foods in the fridge but you just didn't plan accordingly and now you've blown your dinner.

That is pretty much what happens when I get any money. I get so excited that I start making my decisions differently- an $4 container of chai here, a trip to Barnes and Noble for the kids there, and before I know it, I'm actually in the hole rather than ahead. So what I'm thinking is I need to have a plan set up so that if I do ever get any extra money again (one day, it might happen, you never know) that I would have a better idea of where I wanted that money to go. I think that I'll create a wish list, and use that to clarify my ideas. For example, my current wish list would look like this:

You know how sometimes you're really hungry, and you're going to cook dinner, but you don't know what you want so you end up eating a bunch of random stuff out of the fridge, and then you realize you're full and you had potato chips, Camembert and an apple for dinner? (That's what I had last night when this happened to me). And then you're sort of pissed, because you had all kinds of good, healthy foods in the fridge but you just didn't plan accordingly and now you've blown your dinner.

That is pretty much what happens when I get any money. I get so excited that I start making my decisions differently- an $4 container of chai here, a trip to Barnes and Noble for the kids there, and before I know it, I'm actually in the hole rather than ahead. So what I'm thinking is I need to have a plan set up so that if I do ever get any extra money again (one day, it might happen, you never know) that I would have a better idea of where I wanted that money to go. I think that I'll create a wish list, and use that to clarify my ideas. For example, my current wish list would look like this:

- a laptop

- a new purse for fall

- brown heels

- compost bin

So, it would work like this. I would suddenly get an extra 100 dollars from somewhere. I would look at my priority list and think, "Well, I could buy the compost bin now, or the purse and the heels now, or put the money towards the laptop, or any combination that works." By doing this, I wouldn't blow the money on stupid things, I would be able to focus on my goals. It's like having dinner planned so you're not distracted by potato chips while you're trying to figure out what to do with the green beans.

Make sense to you? It doesn't make total sense to me, but I think I'm on to something.

29 July 2008

Two Part Series: Spending and Saving

Part One: Spending

This weekend, my friends and I were talking about spending and saving. They were talking about getting allowances, and how they would save up and buy things, but also sort of hoard money. I started thinking about how I deal with money, especially when I have a windfall of sorts. It always disappears faster than I had planned, and I never really understand why. Remember when I got my tax return and all of a sudden went over my grocery budget even though I hadn't had a problem like that in months? Well, this is what happens when I have extra money.

So then I realized, I don't know how to spend money. Sure, I spend money, but I have no idea how to spend it properly. When I get money, I either pay bills with it (something I'm comfortable with) or spend it on who knows what, but what I don't do is take my extra money and actually make the most of it. So what ends up happening is I feel like I have wasted my money, or I overspend, or both, and I don't really end up getting what I need the most.

I think that when you're used to impulse shopping, you don't learn how to plan to spend. I plan to pay bills each week, and I do that well. I'm comfortable with the pattern of it, I understand how much I have and how much I need, and I know when to do it- they give me a deadline! But with spending on things, there's no minimum payment, there's no goal, and there's no deadline. It's confusing. And confusion leads to mistakes, as anyone without a budget knows. You'll always forget about something, and that something will usually screw you.

I'm going to be thinking this over for the next few days, and trying to apply my decent bill-paying skills to my spending skills. I'll post a spending plan when I have a good one set up.

This weekend, my friends and I were talking about spending and saving. They were talking about getting allowances, and how they would save up and buy things, but also sort of hoard money. I started thinking about how I deal with money, especially when I have a windfall of sorts. It always disappears faster than I had planned, and I never really understand why. Remember when I got my tax return and all of a sudden went over my grocery budget even though I hadn't had a problem like that in months? Well, this is what happens when I have extra money.

So then I realized, I don't know how to spend money. Sure, I spend money, but I have no idea how to spend it properly. When I get money, I either pay bills with it (something I'm comfortable with) or spend it on who knows what, but what I don't do is take my extra money and actually make the most of it. So what ends up happening is I feel like I have wasted my money, or I overspend, or both, and I don't really end up getting what I need the most.

I think that when you're used to impulse shopping, you don't learn how to plan to spend. I plan to pay bills each week, and I do that well. I'm comfortable with the pattern of it, I understand how much I have and how much I need, and I know when to do it- they give me a deadline! But with spending on things, there's no minimum payment, there's no goal, and there's no deadline. It's confusing. And confusion leads to mistakes, as anyone without a budget knows. You'll always forget about something, and that something will usually screw you.

I'm going to be thinking this over for the next few days, and trying to apply my decent bill-paying skills to my spending skills. I'll post a spending plan when I have a good one set up.

28 July 2008

too.much.fiber.

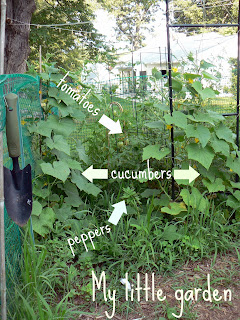

I haven't really been talking about what's going on in the garden like I wanted to or I should, and I certainly haven't been taking enough pictures. But what I can tell you is things are ripe and it's been awesome. I've harvested 4 or 5 zucchinis, 3 cucumbers, 2 Early Girl tomatoes, a big handful of Yellow Pear tomatoes, and today we picked our first Super Sweet 100 tomato, the little cherry, which Max promptly ate.

I've pulled out the old cauliflower and lettuce plants and planted more lettuce, spinach and beets, as well as some sugar snap peas, which came up super fast. I planted them 8 days ago and they are already about 2 inches tall! I mixed some organic fertilizer with water and soaked them in that before planting, so I'll bet that's why. Still, 8 days! Crazy.

My dear friends who came this weekend brought me produce from the farm and I've eaten half of it, easily. I might explode from the fiber, but it was so good. Tonight I made whole wheat rotini with Alfredo sauce, and sauteed zucchini, carrots and yellow pear tomatoes in olive oil, and then made a salad too. Yum.

Finally, I got my Nintendo DS today. It is SO fun. I have more to say about spending money, which I'll post tomorrow, but I just needed to talk produce for a bit. Too many tomatoes will make a girl a little loopy.

I've pulled out the old cauliflower and lettuce plants and planted more lettuce, spinach and beets, as well as some sugar snap peas, which came up super fast. I planted them 8 days ago and they are already about 2 inches tall! I mixed some organic fertilizer with water and soaked them in that before planting, so I'll bet that's why. Still, 8 days! Crazy.

My dear friends who came this weekend brought me produce from the farm and I've eaten half of it, easily. I might explode from the fiber, but it was so good. Tonight I made whole wheat rotini with Alfredo sauce, and sauteed zucchini, carrots and yellow pear tomatoes in olive oil, and then made a salad too. Yum.

Finally, I got my Nintendo DS today. It is SO fun. I have more to say about spending money, which I'll post tomorrow, but I just needed to talk produce for a bit. Too many tomatoes will make a girl a little loopy.

27 July 2008

you guys are the best

Last night I had a birthday party, and my friends all came over and we ate and drank and laughed a lot and it was really very wonderful. I wasn't expecting presents, but I got some awesome ones, so that was a treat too. I'm so very lucky.

This year has been a rough one. It's been a year since my husband moved out and my single working mom life started, and it's been nearly 7 months now since I started the Year of Frugal Living. Lots of things have changed, and while all those changes haven't been easy, I really can't think of one that hasn't been for the best.

So, thanks guys. All of you, IRL life friends and blog friends, inspire me. I'm lucky to have you.

This year has been a rough one. It's been a year since my husband moved out and my single working mom life started, and it's been nearly 7 months now since I started the Year of Frugal Living. Lots of things have changed, and while all those changes haven't been easy, I really can't think of one that hasn't been for the best.

So, thanks guys. All of you, IRL life friends and blog friends, inspire me. I'm lucky to have you.

24 July 2008

I'm planning on being depressed this winter

I've found so much joy and release in gardening and being outside every day that today's grey and rainy weather made me realize that this winter is going to be hard. Right now I'm working on a series of hobbies-to-be that I can pick up when the sun starts to set at 4:30 or whatever bullshit time the sun sets in the dead of winter. Reading, sewing, playing the guitar, baking- they'll all be good, nothing like digging in sticky black dirt and foraging through zucchini leaves, but good too.

For my birthday I struck it rich. Not really, but all the parental figures gave me money, so I'm now able to buy the compost bin I want, and the Nintendo DS I've always wanted. My birthday money came in cards with messages like "don't pay bills with this" and "buy something for yourshelf" from my dad, the original kre8tiv speller. (One time he wrote "I can't believe its butter" on the grocery list and my sister and I laughed for, well, we're still laughing about that one. Picture the commercials for that product: "I can't believe its butter! This stuff tastes like shit!" Anyway... ) So I'm making an effort to listen. Now that I'm 30, I'm probably a much better listener.

For my birthday I struck it rich. Not really, but all the parental figures gave me money, so I'm now able to buy the compost bin I want, and the Nintendo DS I've always wanted. My birthday money came in cards with messages like "don't pay bills with this" and "buy something for yourshelf" from my dad, the original kre8tiv speller. (One time he wrote "I can't believe its butter" on the grocery list and my sister and I laughed for, well, we're still laughing about that one. Picture the commercials for that product: "I can't believe its butter! This stuff tastes like shit!" Anyway... ) So I'm making an effort to listen. Now that I'm 30, I'm probably a much better listener.

23 July 2008

God you're old

It's my birthday! I'm 30 today. It's a big birthday, and I'm a big birthday lover, so I'm really excited. I'm wearing a party dress to work, and I baked a raspberry buttermilk cake from scratch, complete with lemon zest. It was very complicated.

On the one hand, today marks a series of failures. I wanted to do a lot of things by the time I was 30: be (credit card) debt free, own a home, have three kids. On the other hand, I have a lot to show for 30, too: two boys, a master's degree, a great job, lots of friends. And I still fit in the same jeans I wore in high school. So I may not have a house, but at least I still have a nice butt.

All in all, good times.

On the one hand, today marks a series of failures. I wanted to do a lot of things by the time I was 30: be (credit card) debt free, own a home, have three kids. On the other hand, I have a lot to show for 30, too: two boys, a master's degree, a great job, lots of friends. And I still fit in the same jeans I wore in high school. So I may not have a house, but at least I still have a nice butt.

All in all, good times.

22 July 2008

breakup sex

Hey Target,

I just want to say that it was pretty messed up of you to take advantage of me like that today. All I wanted to do was return your shirt and get some snacks for the kids. I really didn't expect you to throw yourself at me like that. I should have known better than to go in there alone, and as soon as I saw that short skirt you had out front it was all over. I know you're cheap, but you're not that cheap. Have a little dignity, please.

I won't be coming to see you again. I'll keep those dresses you threw at me today, even if they don't fit. I just can't trust myself around you. I can't even trust my mother to bring them back, because of the way you are. Now that is just SICK.

Up yours,

Jaime

I just want to say that it was pretty messed up of you to take advantage of me like that today. All I wanted to do was return your shirt and get some snacks for the kids. I really didn't expect you to throw yourself at me like that. I should have known better than to go in there alone, and as soon as I saw that short skirt you had out front it was all over. I know you're cheap, but you're not that cheap. Have a little dignity, please.

I won't be coming to see you again. I'll keep those dresses you threw at me today, even if they don't fit. I just can't trust myself around you. I can't even trust my mother to bring them back, because of the way you are. Now that is just SICK.

Up yours,

Jaime

21 July 2008

the importance of fun money

Every financial advisor will tell you that you need to give yourself a little fun money so you don't feel deprived. The same goes for anyone trying to lose weight, it's important to make sure you have a cookie now and then or you're setting yourself up for failure.

But how much fun money? How to handle it? Does it go in your budget or do you use it as a reward (as in, I pay off this bill and I can have dinner out)?

I've never really had a good grasp on this idea. I don't have it in my budget, and I don't have any rewards set up. Basically, I'm not taking my own advice. So today, after talking to my frugalista coworker E about fun money, and getting a little stressed out in work, I decided to give myself 10 bucks to blow in CVS. I won't tell you what I bought because I don't want to publically admit to smoking and eating junk food, but it was fun, and the funny part is, I only spent 7 dollars!

But how much fun money? How to handle it? Does it go in your budget or do you use it as a reward (as in, I pay off this bill and I can have dinner out)?

I've never really had a good grasp on this idea. I don't have it in my budget, and I don't have any rewards set up. Basically, I'm not taking my own advice. So today, after talking to my frugalista coworker E about fun money, and getting a little stressed out in work, I decided to give myself 10 bucks to blow in CVS. I won't tell you what I bought because I don't want to publically admit to smoking and eating junk food, but it was fun, and the funny part is, I only spent 7 dollars!

20 July 2008

we can still be friends

Dear Target,

I don't really know how to say this, so I'm just going to come out and say it. I think we need a break. It's not you, it's me. Ever since I started the Year of Frugal Living, I just haven't felt the same way about you. I mean, we have so many great memories, but lately I've just felt like you're sort of, well, a bad influence on me. It's like you bring out this wild side of me that I just don't think is a good thing. Maybe when things are different, we can see each other again. For right now, I'm just asking that you stop sending me those letters every Sunday- you know, the ones with the sexy pictures. I think we both know you're hot, you don't need to advertise it. Honestly, it just makes you look cheap.

Anyway, I promise I'll stop by to see you once in a while, for the kids' sake at least. Take care of yourself.

Jaime

I don't really know how to say this, so I'm just going to come out and say it. I think we need a break. It's not you, it's me. Ever since I started the Year of Frugal Living, I just haven't felt the same way about you. I mean, we have so many great memories, but lately I've just felt like you're sort of, well, a bad influence on me. It's like you bring out this wild side of me that I just don't think is a good thing. Maybe when things are different, we can see each other again. For right now, I'm just asking that you stop sending me those letters every Sunday- you know, the ones with the sexy pictures. I think we both know you're hot, you don't need to advertise it. Honestly, it just makes you look cheap.

Anyway, I promise I'll stop by to see you once in a while, for the kids' sake at least. Take care of yourself.

Jaime

19 July 2008

Paper Towel Challenge update #2 (Cape Cod memories)

So, it turns out the Paper Towel Challenge isn't much of a challenge. I'm only about a half a roll down, and most of that is due to the fact that I had my son's birthday party and some people (gasp) used paper towels (most likely the same people who threw away the plastic plates. People.)

I'm loving the cloth napkins. My college roommate and close friend is from Cape Cod, and sometimes I would go home with her to the Cape. If you haven't been to the Cape, its sort of a magical place. Growing up, every summer my family would go there for a week and stay in my aunt's cottage in Orleans. It was a small two bedroom cottage, with thin walls and a yellow painted kitchen table. The air always smelled salty and a little bit musty, but in a sweet way. There were bikes there, and you could ride your bike to the bay or take the bike path to town. Those were the kinds of decisions you had to make. It was always wonderful.

So, when I'd visit my friend's family, it reminded me of those Cape Cod weeks, and her parents house was so cool. They had a stereo in their kitchen and they listened to music and danced while they cooked, and they had a drawer with cloth napkins. I remember going there and being shocked by this, mainly because my family was a family that often didn't eat together at all. As an adult, and a parent, I wanted that house with the music and the multicolored cloth napkins, and now I have it. Its nice when your adult self can remember, and actually do, the things that your child self dreamed of.

If you want something wonderful to listen to, get the Juno soundtrack. We've been dancing until sweat was pouring off all of us.

I'm loving the cloth napkins. My college roommate and close friend is from Cape Cod, and sometimes I would go home with her to the Cape. If you haven't been to the Cape, its sort of a magical place. Growing up, every summer my family would go there for a week and stay in my aunt's cottage in Orleans. It was a small two bedroom cottage, with thin walls and a yellow painted kitchen table. The air always smelled salty and a little bit musty, but in a sweet way. There were bikes there, and you could ride your bike to the bay or take the bike path to town. Those were the kinds of decisions you had to make. It was always wonderful.

So, when I'd visit my friend's family, it reminded me of those Cape Cod weeks, and her parents house was so cool. They had a stereo in their kitchen and they listened to music and danced while they cooked, and they had a drawer with cloth napkins. I remember going there and being shocked by this, mainly because my family was a family that often didn't eat together at all. As an adult, and a parent, I wanted that house with the music and the multicolored cloth napkins, and now I have it. Its nice when your adult self can remember, and actually do, the things that your child self dreamed of.

If you want something wonderful to listen to, get the Juno soundtrack. We've been dancing until sweat was pouring off all of us.

18 July 2008

hmmm... christmas.

When I was writing about how I'm getting boring, one of you commented that you'd like to know what I'm doing about the holidays and presents and all that. I've been thinking about my answer for 24 hours, and well, I'm still not sure. Last Christmas I got by not spending too much (according to Microsoft Money I only spent 145.00 on Christmas last year, there is no way that's true but I'm sure it was under 400).

There are two reasons I was able to do this: 1) I don't have a big family and 2) I told everyone it was going to be a budget Christmas and I made a lot of gifts. Shutterfly and Snapfish both had really great promotions in Oct/Nov that I used to make photo books and calendars for my parents and inlaws. My kids got a couple of small toys, and my dad only wanted slippers. My sister and I didn't exchange, and I don't have any more family members. So, I guess there are times when it's nice to be from a small family.

Now, this year I have the luxury most people do not, I actually write a blog called The Year of Frugal Living and everyone knows it, so they won't be expecting much. But I will need some money, and this is what I came up with:

For me, about 300.00 should suffice. As of today, there are 20 weeks until December 8th, a reasonable time to start shopping. Since 20x15= 300 (obvious math!), if I put away 15.00 every Friday, by December I'll have 300 bucks to spend on Christmas. Honestly, I feel like this is a lot of money for me, but if I have leftover money, I can put it away for other gift giving occasions.

So, that's a plan. Thanks Katy (person who asked)!

There are two reasons I was able to do this: 1) I don't have a big family and 2) I told everyone it was going to be a budget Christmas and I made a lot of gifts. Shutterfly and Snapfish both had really great promotions in Oct/Nov that I used to make photo books and calendars for my parents and inlaws. My kids got a couple of small toys, and my dad only wanted slippers. My sister and I didn't exchange, and I don't have any more family members. So, I guess there are times when it's nice to be from a small family.

Now, this year I have the luxury most people do not, I actually write a blog called The Year of Frugal Living and everyone knows it, so they won't be expecting much. But I will need some money, and this is what I came up with:

For me, about 300.00 should suffice. As of today, there are 20 weeks until December 8th, a reasonable time to start shopping. Since 20x15= 300 (obvious math!), if I put away 15.00 every Friday, by December I'll have 300 bucks to spend on Christmas. Honestly, I feel like this is a lot of money for me, but if I have leftover money, I can put it away for other gift giving occasions.

So, that's a plan. Thanks Katy (person who asked)!

17 July 2008

good times

The problem I have with this blog is when things are good, I don't have as much to talk about. For example, yesterday's post could have gone like this:

Didn't buy anything unnecessary today. Paid no bills but didn't need to. Dad brought over dinner and that was free. Spent the evening swinging on the swings with kids and eating a sugar baby watermelon from the farmer's market.

That's true, but boring! But, I have to say, right now things are good. I got paid today but still had money left in my checking account from the week before. I'm having friends over today for lunch and tonight to watch Project Runway, and I have plenty of food for that. My birthday is in 6 days, I'll be 30, and I'm having a potluck in my backyard to celebrate.

I owe you some garden photos, but I'm pretty much ready to harvest the first zucchini and eggplants, and I have several cukes and tomatoes that are nearly there. The garden is a little crazy but it's beautiful. I'll be planting for fall this week. Good times!

Didn't buy anything unnecessary today. Paid no bills but didn't need to. Dad brought over dinner and that was free. Spent the evening swinging on the swings with kids and eating a sugar baby watermelon from the farmer's market.

That's true, but boring! But, I have to say, right now things are good. I got paid today but still had money left in my checking account from the week before. I'm having friends over today for lunch and tonight to watch Project Runway, and I have plenty of food for that. My birthday is in 6 days, I'll be 30, and I'm having a potluck in my backyard to celebrate.

I owe you some garden photos, but I'm pretty much ready to harvest the first zucchini and eggplants, and I have several cukes and tomatoes that are nearly there. The garden is a little crazy but it's beautiful. I'll be planting for fall this week. Good times!

16 July 2008

you deserve it

I've had a series of conversations lately about deserving the things you have in your life. Its become clear to me and some people I've been speaking with that if you put yourself out there, most of the time good things come to you. The problem is that most people will not or cannot put themselves out there enough to reap the rewards.

So this is what I think we should all say to ourselves when we feel unmotivated to save or compelled to spend:

I deserve to be debt free. I deserve to sleep at night knowing I have money in the bank. I deserve to put my happiness ahead of the materials goods I think will make me happy. They won't make me happy, only I can make me happy.

You deserve it, and so do I.

So this is what I think we should all say to ourselves when we feel unmotivated to save or compelled to spend:

I deserve to be debt free. I deserve to sleep at night knowing I have money in the bank. I deserve to put my happiness ahead of the materials goods I think will make me happy. They won't make me happy, only I can make me happy.

You deserve it, and so do I.

15 July 2008

cheap therapy

Last night was a long night. I don't sleep well, being alone in the house and having a very cute yet annoying cat doesn't help. Then someone's car alarm went off at about 4:30, which never happens, so I woke up in a panic and spent the next 15 minutes checking all the kids and doors. Last summer there was a terrible home invasion in my state, a mom and her two daughters were killed and it happened right after my husband moved out. It actually happened ON my birthday, which is a week from tomorrow. I've never really recovered my sense of security since that day, I still obsessively check the doors and wake up often during the night. No good.

(Deep breath)

Quite a few people have said that walking or running would be a good stress release for me, and I agree. So I'll be doing that at lunch today, lest I have some sort of nervous breakdown/ panic attack. Okay, not really, but I need some sort of therapy, and obviously retail therapy just ain't gonna cut it. (I DO see a therapist, just not this week, in case you're thinking that I need to. Thanks, though.)

And so, cheap therapy consists of putting on your sneakers and running around until things make sense and you can come home again. Love those metaphors.

***Edited to add: I just got back from lunch. I ran/walked for about 25 minutes and I feel AWESOME! I'm so glad I went. I need to do this several times a week, for my own sanity, even if I spend a little extra on gas. (Or I could just be smelly at work for the last 2 hours).

(Deep breath)

Quite a few people have said that walking or running would be a good stress release for me, and I agree. So I'll be doing that at lunch today, lest I have some sort of nervous breakdown/ panic attack. Okay, not really, but I need some sort of therapy, and obviously retail therapy just ain't gonna cut it. (I DO see a therapist, just not this week, in case you're thinking that I need to. Thanks, though.)

And so, cheap therapy consists of putting on your sneakers and running around until things make sense and you can come home again. Love those metaphors.

***Edited to add: I just got back from lunch. I ran/walked for about 25 minutes and I feel AWESOME! I'm so glad I went. I need to do this several times a week, for my own sanity, even if I spend a little extra on gas. (Or I could just be smelly at work for the last 2 hours).

14 July 2008

Staying home is a wonderful, wonderful thing

My children spend Sundays with their father, which is wonderful for all of us. Typically, I spend this quality alone time (something I didn't get much of as a SAHM of two children born 18 months apart) leisurely perusing Target clearance racks and watching shows like "Rock of Love II." After last Sunday's financial indiscretions, however, I decided that this Sunday was best spent at home.

It was sort of, well, glorious- although I of course- OF COURSE- missed my children. And I was certainly eager to get them back. But in the meanwhile, I hung laundry on the clothesline. I weeded my garden and tied up my cucumbers. I cleaned my bedroom. I moved my winter clothes out of my closet. I pet my cats, I ate homemade bread (another new obsession), and I posted on the Bargain Board. I blogged. I took a shower. I ate a gigantic chicken sandwich with my grandma's cucumber salad for lunch, and had a beer and sat in a chair in the backyard. It was a beautiful, bright and windy day. It was a great day.

And I didn't spend a dime.

It was sort of, well, glorious- although I of course- OF COURSE- missed my children. And I was certainly eager to get them back. But in the meanwhile, I hung laundry on the clothesline. I weeded my garden and tied up my cucumbers. I cleaned my bedroom. I moved my winter clothes out of my closet. I pet my cats, I ate homemade bread (another new obsession), and I posted on the Bargain Board. I blogged. I took a shower. I ate a gigantic chicken sandwich with my grandma's cucumber salad for lunch, and had a beer and sat in a chair in the backyard. It was a beautiful, bright and windy day. It was a great day.

And I didn't spend a dime.

Amma's Cucumber Salad

(slightly modified from the Better Homes and Gardens cookbook)

1 cup sour cream

1 tbsp vinegar

1 tsp sugar

1/4 tsp dill

1/4 tsp salt

pepper

1 large cucumber, peeled, halved and thinly sliced

Mix ingredients in a bowl, toss in cucumber. Refrigerate, covered, for 2 to 24 hours. Stir occasionally. Eat all.

13 July 2008

How I budget

Over the last 7 months, I've had a lot of people ask me how I am doing this. Here is one part of it, my budget. I should first point out that I'm really obsessed with, and really good at, Microsoft Excel spreadsheets, so that is what I use, but you don't have to do what I do. This is just how I do it.

For each month, I have a column that looks like this:

4 Jul 08 $amount of pay

Savings $.$$

CC Bill $.$$

Daycare $.$$

Phone Bill $.$$

Total Left $.$$

11 Jul 08 $pay

Savings $.$$

Daycare $.$$

CC Bill $.$$

Total Left $.$$

18 Jul 08 $ pay

Savings $.$$

Daycare $.$$

Car Payment $.$$

CC Bill $.$$

Renter's Insurance $.$$

Total Left $.$$

25 Jul 08 $ pay

Savings $.$$

Daycare $.$$

Rent $.$$

CC Bill $.$$

Total Left $.$$

So, depending on what is due that week, and how much I have coming in, I either put money into savings, or take money out of savings. About every six months, I add six months onto the bottom of the spreadsheet, and I start at the latest date with 0.00 in savings and work backwards, so I always have enough in my savings account to pay everything on time.

Now, this is where it gets a little tricky. I actually have another sheet in this excel book that keeps track of what is in savings. I use an excel formula to automatically copy the amount coming in or out of savings into the savings sheet, and if I go in the red on that sheet, I know immediately. If anyone really wants to try this, I can tell you what the formulas are.

Next to each bill is a box that I mark with an X when I pay it, and I add a comment that has the confirmation number in case I need that. To the right of the amount is the date it is due, so I'm not late.

I pay all my bills except my car loan, which is through a very small credit union, online. To balance my checking account, I use Microsoft Money. I import my checking account register into Money, and balance it in Money, which is very easy.

That's it! (Stop laughing at how complicated I made this. I'm a librarian, I like to organize things).

For each month, I have a column that looks like this:

4 Jul 08 $amount of pay

Savings $.$$

CC Bill $.$$

Daycare $.$$

Phone Bill $.$$

Total Left $.$$

11 Jul 08 $pay

Savings $.$$

Daycare $.$$

CC Bill $.$$

Total Left $.$$

18 Jul 08 $ pay

Savings $.$$

Daycare $.$$

Car Payment $.$$

CC Bill $.$$

Renter's Insurance $.$$

Total Left $.$$

25 Jul 08 $ pay

Savings $.$$

Daycare $.$$

Rent $.$$

CC Bill $.$$

Total Left $.$$

So, depending on what is due that week, and how much I have coming in, I either put money into savings, or take money out of savings. About every six months, I add six months onto the bottom of the spreadsheet, and I start at the latest date with 0.00 in savings and work backwards, so I always have enough in my savings account to pay everything on time.

Now, this is where it gets a little tricky. I actually have another sheet in this excel book that keeps track of what is in savings. I use an excel formula to automatically copy the amount coming in or out of savings into the savings sheet, and if I go in the red on that sheet, I know immediately. If anyone really wants to try this, I can tell you what the formulas are.

Next to each bill is a box that I mark with an X when I pay it, and I add a comment that has the confirmation number in case I need that. To the right of the amount is the date it is due, so I'm not late.

I pay all my bills except my car loan, which is through a very small credit union, online. To balance my checking account, I use Microsoft Money. I import my checking account register into Money, and balance it in Money, which is very easy.

That's it! (Stop laughing at how complicated I made this. I'm a librarian, I like to organize things).

12 July 2008

shopping for vices

I don't talk about my personal life all that much, this blog is really about this frugal living mission, but I do talk about my kids and my divorce sometimes. To make a long story short, my soon to be ex husband has some problems that became serious and made it a bad idea for me to stay with him. So, there's that.

Most likely due to my little baby turning two, and the one year anniversary of my marriage breaking up, I've been really down lately. Historically, when I'm down, a fall into a bad pattern of vices, and this time was almost no exception. The shopping that went on last week was certainly some retail therapy (that ended up making me feel worse), I even started smoking again (I smoked before I got pg with my oldest) but I stopped that, too. I stayed up too late, went to bed too early, didn't eat at all, and ate ice cream all day. Typically, I would temporarily feel better from doing any of these things, but I didn't this time.

I will never forget the day, when I was 21, poor, living in Providence, RI, and feeling really depressed. That day I thought that yoga might be my salvation, and during a trip to Whole Foods, I saw a yoga mat. I spent $30 on that yoga mat, and since I was poor, I charged it on my credit card. If I were to trace that charge, I'd be willing to guarantee that I'm still paying for that yoga mat. I've probably paid $200 for it, after interest and finance charges and long ago late fees. At least I still use it, but there are plenty of things I don't still use, but I'm paying for. That's enough to drive anyone to drink (a vice I am luckily not indulging in, because I have my kids to take care of).

If it were now, and I wanted to do something new, I would know better than to impulse buy it. I would see if I could borrow it from the library or a friend, look on ebay or craig's list. I would blog about it on here to get it out of my system. Maybe I'd even decide I still really wanted it and I'd save up the money. That's all good.

Now I just have to figure out what cheap vice I can have now that will make me feel better. I'm thinking walking/running. We'll see.

Most likely due to my little baby turning two, and the one year anniversary of my marriage breaking up, I've been really down lately. Historically, when I'm down, a fall into a bad pattern of vices, and this time was almost no exception. The shopping that went on last week was certainly some retail therapy (that ended up making me feel worse), I even started smoking again (I smoked before I got pg with my oldest) but I stopped that, too. I stayed up too late, went to bed too early, didn't eat at all, and ate ice cream all day. Typically, I would temporarily feel better from doing any of these things, but I didn't this time.

I will never forget the day, when I was 21, poor, living in Providence, RI, and feeling really depressed. That day I thought that yoga might be my salvation, and during a trip to Whole Foods, I saw a yoga mat. I spent $30 on that yoga mat, and since I was poor, I charged it on my credit card. If I were to trace that charge, I'd be willing to guarantee that I'm still paying for that yoga mat. I've probably paid $200 for it, after interest and finance charges and long ago late fees. At least I still use it, but there are plenty of things I don't still use, but I'm paying for. That's enough to drive anyone to drink (a vice I am luckily not indulging in, because I have my kids to take care of).

If it were now, and I wanted to do something new, I would know better than to impulse buy it. I would see if I could borrow it from the library or a friend, look on ebay or craig's list. I would blog about it on here to get it out of my system. Maybe I'd even decide I still really wanted it and I'd save up the money. That's all good.

Now I just have to figure out what cheap vice I can have now that will make me feel better. I'm thinking walking/running. We'll see.

11 July 2008

frugalistas are hip, being frugal is smart

This morning, while I was getting ready for work, I was watching Jim Kramer on the news, talking about this American Dream special. He was giving this really rallying speech about how we, as Americans, are winners and how even if Fannie Mae/ Freddie Mac fold, the government will step in and take care of it, and we'll have mortgages and be okay.

Then yesterday I read something Suze Orman (who I love) said about how people aren't REALLY changing their ways from this economy, they are just changing them for right now, because they have to, but people will go back to their old habits when the economy improves.

Realistically, Suze's probably right. I mean, Suze's always right, even if you don't want to hear it. (If you don't watch her, there's a part of her show where people call in and ask if they can afford to buy certain things. Most of the time, she says no.)For example, you wouldn't believe how many people say things to me like "when this year is over, you can go on a shopping spree!" Yeah, um, that isn't the point!

I don't have much of a point tonight, except to say that while, as Ashley so eloquently put it this week, "frugal is the new green," let's hope that neither of them are the new pegged jeans, or macarena, or fondue party. If we need to be down with the new fads, we can all go get the new iPhone.

Then yesterday I read something Suze Orman (who I love) said about how people aren't REALLY changing their ways from this economy, they are just changing them for right now, because they have to, but people will go back to their old habits when the economy improves.

Realistically, Suze's probably right. I mean, Suze's always right, even if you don't want to hear it. (If you don't watch her, there's a part of her show where people call in and ask if they can afford to buy certain things. Most of the time, she says no.)For example, you wouldn't believe how many people say things to me like "when this year is over, you can go on a shopping spree!" Yeah, um, that isn't the point!

I don't have much of a point tonight, except to say that while, as Ashley so eloquently put it this week, "frugal is the new green," let's hope that neither of them are the new pegged jeans, or macarena, or fondue party. If we need to be down with the new fads, we can all go get the new iPhone.

10 July 2008

i think it's working

I've hardly spent any money at all since the big shopping trip pity party. I think that choosing to do the debt snowball as a way of shifting focus has really renewed my energy. I have a small debt that I will be able to pay off shortly after saving up my emergency fund that will definitely be motivational, and that should happen sometime in September. The moral of the story is, change it up!

07 July 2008

Obvious Math, Part Duex

So, I figured out how to save up $1000 (well, 900- there's that obvious math again) by August 1st, barring any sort of catastrophes. So, that will be Dave Ramsey Baby Step One. Step Two is that old Debt Snowball, which I believe I will be balling for like three years, but it's okay. We can have the decade of frugal living, and by then I'll have many readers and perhaps a book named something like "Insanity Pants: How I Stopped Shopping and Found True Happiness."

feeling better

I don't know if it was the beer I drank last night or the visit to the "we're debt free!" group on the new babycenter, but I'm feeling newly motivated today. I've decided that I'm absolutely going to start doing the Dave Ramsey method, starting today. This means that I'm on Baby Step 1, or saving up $1000 for an emergency fund. Sad as it is to say, I only have 100 dollars in my savings account, so I'll need to put another 900 in (hi, obvious math) and then I'm on to step 2.

I'm home today because Mikey has a touch of the stomach bug and I didn't want my babysitter to have to deal with it, it's gross. When they nap later, I'm gonna take a look at my budget and see where I can dig up a grand. Will report later!

I'm home today because Mikey has a touch of the stomach bug and I didn't want my babysitter to have to deal with it, it's gross. When they nap later, I'm gonna take a look at my budget and see where I can dig up a grand. Will report later!

06 July 2008

Charge it at Target, or, The Call of the Mall

Damn it! I am not entirely sure what is wrong with me lately, but I have been spending a lot more money than usual. I'm sure part of it has to do with the fact that I've been feeling really down lately, because of some issues that are going on with my soon-to-be ex. After going to the Gap on Thursday and spending 89.00 on clothes, I went to the mall yesterday and bought my 3 year old some underwear (12.00) and lunch for all of us (30.00). Then I went to Target today, and spent another 80.00. I bought 2 shirts for me (one of which is going back, it was 13.00), a tshirt for Mikey (the 3 year old), a puzzle for Mikey (he's sick, which is why I think I'm buying him stuff, plus I told him that he is probably feeling better and should stop talking about it and my Mother in Law gave me a really nasty look which made me feel worse, even though he likes to say he's sick when he isn't... ugh. Mommy guilt.), a pair of shoes for work, a set of Pyrex baking dishes with lids, a box of garbage bags and some diapers for Max. These were all things that I needed, but didn't REALLY need, which is why I feel so guilty.

My friend reminded me that being frugal doesn't mean not spending ANY money at all, but I still feel like I messed up. I have been thinking and thinking lately about how I really should have cancelled my cable and internet for this year, and probably my cell phone or at least downgraded to a cheapy one, but I didn't. I guess it didn't seem worth it to me, but now I feel like I didn't really go all out with this. Maybe I'm just being hard on myself because I'm feeling down about other things, in which case it should get better soon, but for today, I feel like I effed up. So, sorry.

My friend reminded me that being frugal doesn't mean not spending ANY money at all, but I still feel like I messed up. I have been thinking and thinking lately about how I really should have cancelled my cable and internet for this year, and probably my cell phone or at least downgraded to a cheapy one, but I didn't. I guess it didn't seem worth it to me, but now I feel like I didn't really go all out with this. Maybe I'm just being hard on myself because I'm feeling down about other things, in which case it should get better soon, but for today, I feel like I effed up. So, sorry.

04 July 2008

Me and the Debt Snowball

If your familiar with Dave Ramsey and his debt snowball, then you know that the premise is to pay the minimum payment on all but your lowest debt balance, and put the rest of your available cash towards that debt until its paid off. The idea behind paying your lowest balance first is that seeing those debts disappear keeps you motivated, even if it might make more sense financially to pay the highest interest rate debt off first.

Since I have a whole blog about paying off debt, I've been doing the highest interest rate version, because I figured I wouldn't need that extra motivation. Honestly, though, its getting a little discouraging to have it be July and not really have any less bills, even if those balances have shrunk. So, for the second half of the year, I think I'll switch over to the traditional Dave Ramsey plan, including the 1000 dollars you're supposed to have in you savings, just to mix things up a bit. If its much more stimulating, then I can continue on with that plan next year instead.

Will let you know how it goes! (Obviously)

Since I have a whole blog about paying off debt, I've been doing the highest interest rate version, because I figured I wouldn't need that extra motivation. Honestly, though, its getting a little discouraging to have it be July and not really have any less bills, even if those balances have shrunk. So, for the second half of the year, I think I'll switch over to the traditional Dave Ramsey plan, including the 1000 dollars you're supposed to have in you savings, just to mix things up a bit. If its much more stimulating, then I can continue on with that plan next year instead.

Will let you know how it goes! (Obviously)

03 July 2008

Going to the Gap-el and we're gonna get sale stu-uh-uh-uff

Gap is having a sale, it's 25% off the already marked down sale stuff, and, if you have coupons like me (because it is my birthday this month I got a $15 off $60 and I also earned a $10 reward cert with my gap card) then it makes for a pretty sweet deal. I got 1 pair of work pants, 2 pairs shorts (in direct opposition to my very public anti-shorts philosophy, these particular bermudas were actually not that ugly), 2 dresses, 2 t shirts, 2 pairs of socks, and a leather belt, and I spent $80.

Why? Because I haven't bought any clothes in quite a while, and especially not summer clothes. So, that was a good deal.

Also, I found out today that Beck's new record is being released July 8th, which I can only assume is because my birthday is coming up. I just love him more every day. Also Rolling Stone gave it 4 stars, which could have been assumed, because he is amazing, but it's nice to be publicly acknowledged for your freaking insane genius and hottie-ness. Okay.

Why? Because I haven't bought any clothes in quite a while, and especially not summer clothes. So, that was a good deal.

Also, I found out today that Beck's new record is being released July 8th, which I can only assume is because my birthday is coming up. I just love him more every day. Also Rolling Stone gave it 4 stars, which could have been assumed, because he is amazing, but it's nice to be publicly acknowledged for your freaking insane genius and hottie-ness. Okay.

02 July 2008

everybody's cooking!

I read a couple blogs, I have them listed on my sidebar if you haven't checked them out. So, everybody's cooking! Ashley made bread, Alicia (Posie Gets Cozy) made thunder cake, and it seems like just about everyone and their mom is making freezer jam. The great thing about blogging and the internet in general is that not only can you find anything you need (for example, the recipe for freezer jam), but reading blogs is a great way to get ideas, get inspired, and learn something new. Okay, PSA over!

Incidentally, I made something called "blueberry boy bait" today. Its like a blueberry coffeecake, but apparently it is supposed to attract boys. Unfortunately, it doesn't specify what age the boys will be!

Incidentally, I made something called "blueberry boy bait" today. Its like a blueberry coffeecake, but apparently it is supposed to attract boys. Unfortunately, it doesn't specify what age the boys will be!

01 July 2008

The Mystery of the Kitty Litter Bags

It's not really a mystery, but I was a big Nancy Drew/ Hardy Boys/ Scooby Doo fan as a child and I thought that sounded cute. Anywho, this is the mystery of the kitty litter bags:

I switched over to reusable grocery bags about a year ago, with no issues save one- when I ultimately ran out of plastic bags, I didn't know what to do with my dirty kitty litter. I scoop, BTW. So, I Googled it, I looked in the Ed Begley Jr book I reviewed in January (Living Like Ed, it was good, check it out at the library), hell, I even posted it as a WWYD on the BHB. But I never really came up with a good solution, and so every couple of shopping trips I would get plastic instead.

That is, until last Saturday when I had Max's birthday party. As I removed 32 rolls from four bags, it dawned on me- I have plenty of bags! Bags of bread, bags of tortillas, bags holding quartets of toilet paper within their gigantic 16-block. Problem solved.

I switched over to reusable grocery bags about a year ago, with no issues save one- when I ultimately ran out of plastic bags, I didn't know what to do with my dirty kitty litter. I scoop, BTW. So, I Googled it, I looked in the Ed Begley Jr book I reviewed in January (Living Like Ed, it was good, check it out at the library), hell, I even posted it as a WWYD on the BHB. But I never really came up with a good solution, and so every couple of shopping trips I would get plastic instead.

That is, until last Saturday when I had Max's birthday party. As I removed 32 rolls from four bags, it dawned on me- I have plenty of bags! Bags of bread, bags of tortillas, bags holding quartets of toilet paper within their gigantic 16-block. Problem solved.

Subscribe to:

Posts (Atom)